Category: Something to Think About

The Changing face of Debt in Canada

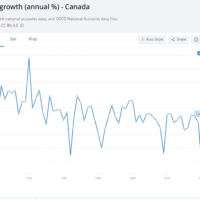

Debt in Canada has outgrown all domestic production, Canadians now have about five times (5X) as much debt as they do income.

Read moreHOUSE PRICING:

There are many factors that drive house pricing, and a multitude of market conditions, some of which have been very unusual in recent years. Join the conversation, let us know what you think.

Read moreDEATH AND TAXES:

Death and taxes, so cliche, yet so appropriate when talking about Canada’s economy.

Read moreTHE PROBLEM WITH YOUR INCOME:

Income is an often overlooked econmic problem in Canada, people have become so accustomed to using credit to bridge the gap between inflation and their income that they simply accept the status quo.

Read moreHousing Costs

Housing costs have dropped slightly in the home sales sector but remain high in rental markets. Meanwhile incomes are continuing to trend downwards.

Read moreInsolvency Rates Rebound

The economy is in a mess, insolvency rates rebound allowing people to find relief from overwhelming debt levels. Call us today at 519-646-2222 for your free consultation.

Read moreSurplus, what Surplus?

Surplus what surplus? If you are bankrupt and have been assessed for surplus income, and you can’t afford to pay it, do not dispair you have alternative possibilities.

Read moreEveryday Financial Risks

Prepare to face your everyday financial risks, whether they involve leverage or reach, discuss your options and explore alternative ideas.

Read moreInsolvencies are Increasing.

After three years of highly impactful reckless lending, insolvency rates are starting to return to normal filing levels. We anticipate a slight uptick in the new year.

Read moreCompare Debt Solutions

Save your Home – what you need to know!

Canada’s first choice for debt solutions, a proposal, can help you save your home while managing debt.

Read moreDo the Maths

Wallowing in Debt

Liek it or not you are wallowing in debt, consumer debt and anational debt, it is getting to be extremely challenging to live without debt,.

Read moreCredit Cards – pros and cons

Credit cards are the meat and potatoes of the insolvency industry, if they did not proliferate our economy LITs would have far less work. Read on for a discussion of the pros and cons of credit cards.

Read moreImprove Your Credit Rating.

Whether or not you have filed an insolvency proceeding you may find some useful tips, in this blog, to help you manage your credit ratting.

Read moreAmazon – Caveat Emptor (Buyer Beware)

Amazon is a very easy place to spend money, it contributes some jobs to the local economy, but little else, it also dehumanizes and commoditizes us all, taking away the pleasure of human contact when searching for the perfect gift, etc.

Read moreRe-regulate Banks.

Our current mortgage crisis presents viable options for the Government to reregulate banks in a way that will benefit consumers – but will they do the right thing or return to business as usual?

Read moreInterest Rates – again

Interest rates, depending who you listen to, are likely to continue to rise before settling back to historical averages.

Read moreTransferring Property – on the eve of insolvency

Transferring property on the even of filing an insolvency is something that should be done, if at all, following a consultation with your LIT. Transfers can be overturned or there can be other consequences.

Read moreFollow the Money – why debt is a way of life.

Follow the moeny they said, but what money? There really isn’t much money in circulation, which is why Canadians are so dependent on credit.

Read more