Your Consumer Proposal Guide in London, Ontario

Understanding Consumer Proposals

What Exactly is a Consumer Proposal?

A Consumer Proposal is more than just a lifeline—it’s a powerful financial tool. For many Canadians, debts can spiral out of control, making them feel trapped and stressed. A Consumer Proposal, managed by a Licensed Insolvency Trustee, offers a structured, legal way out. It allows individuals drowning in debt to negotiate a reduced amount with creditors. This isn’t just about debt; it’s about regaining a sense of financial freedom.

Consumer Proposal Eligibility Criteria

To step onto the path of a Consumer Proposal:

- You must owe between $1,000 and $250,000 (excluding mortgages). Over $250,000 you may be looking at a Division One Proposal.

- Show that regular debt payments are beyond your reach.

- Apply as an individual, not a business.

The Detailed Consumer Proposal Process

The journey begins with an in-depth consultation with a Licensed Insolvency Trustee. Together, you’ll outline your debts, your income, and your essential expenses. Then, a proposal is carefully crafted to present to your creditors. With patience, await their approval.

Consumer Proposal: Pros, Cons, and Considerations

A Consumer Proposal shines as a beacon for debt reduction without the shadow of bankruptcy. It’s a relief system, allowing you to breathe again without the weight of mounting debts. However, remember that your credit rating will witness a temporary dip, which is a small price for long-term financial stability.

Comprehensive Benefits of a Consumer Proposal

Consumer Proposal’s Role in Debt Reduction

Imagine cutting your mountain of debt by half or even more. A Consumer Proposal can turn that into reality. By assessing your income and essential outgoings, the proposal ensures you repay an amount that’s realistic and manageable.

Protection from Persistent Creditors with a Consumer Proposal

The moment you file your Consumer Proposal, a legal protection kicks in. Those unending, anxiety-inducing calls from creditors? They stop. Legal actions like wage garnishments or looming lawsuits? Halted. It’s like a protective shield against debt-collecting arrows.

Interest Relief Under Consumer Proposal

One of the hidden knives of debt is accumulating interest. With a Consumer Proposal, in most cases, the clock on interest stops ticking from the day you file, saving you from added financial burdens.

Step-by-Step: Applying for a Consumer Proposal

1

Finding a Trustee for Your Consumer Proposal

Your first step is crucial. Locke Consulting, based in the heart of London, Ontario, specializes in guiding individuals through the Consumer Proposal labyrinth, ensuring clarity and confidence.

2

Preparing for Your Consumer Proposal

Gathering and organizing your financial documents might feel daunting, but it’s an essential step. This transparency ensures your creditors have a crystal-clear snapshot of your financial landscape.

3

Crafting Your Unique Consumer Proposal

Every individual’s financial story is unique. With your trustee, you’ll sculpt a Consumer Proposal that reflects your genuine financial situation and a path to relief.

Navigating Consumer Proposal Approval and Beyond

4

Creditor Acceptance in the Consumer Proposal Journey

Once your Consumer Proposal is out in the world, your creditors cast their votes. A majority approval binds every creditor, ensuring uniformity in the debt resolution process.

5

Embracing the Success of Your Consumer Proposal

This is a commitment. By adhering to the proposal’s stipulations and making consistent payments, the doors to a debt-free life swing open. The end of this journey greets you with a sense of unparalleled financial liberation.

Consumer Proposal Alternatives

Consumer Proposal vs. Bankruptcy

While both avenues offer solace from choking debts, a Consumer Proposal is often seen as a gentler path over bankruptcy. It lets you maintain control of your assets and typically has a milder effect on your credit history.

Consumer Proposal vs. Debt Consolidation

Debt consolidation is akin to gathering all your debts and putting them into one basket with a single interest rate. In contrast, a Consumer Proposal aims to reduce the basket’s weight itself. Your choice between the two hinges on your unique financial tapestry.

Articles on Consumer Proposals

-

Post Christmas Debt

Post Christmas Debt is like drinking fine wine, it tastes great at the party but leaves a massive headache in its wake.

-

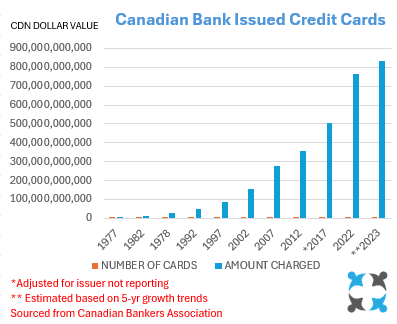

Leverage: who’s leveraging who?

Is it leverage or self-liquidation? The two terms are often confused and sometimes used interchangeably but have quite different meanings.

-

Proposal or Bankruptcy

It’s your choice – proposal or bankruptcy? Your LIT will guide you but not make your decisions for you! In an ideal world you would be able to live without debt.

Frequently Asked Questions

A consumer proposal is a legal agreement set up by a Licensed Insolvency Trustee between you and your creditors. It allows you to repay only a portion of your debts, extend the time you have to pay off the debt, or a combination of both. This arrangement can offer a more manageable way to settle debts without declaring bankruptcy.

Both consumer proposals and bankruptcy are legally binding processes designed to provide relief from debt. The choice between the two depends on individual circumstances:

- Consumer Proposal:

- Allows you to keep your assets.

- Often repays only a portion of your debt.

- Has a lesser impact on your credit score than bankruptcy.

- Debtors make monthly payments over a set period (up to 5 years).

- Bankruptcy:

- May require you to sell some of your assets.

- All eligible debts are cleared at the end.

- A more drastic impact on your credit score.

- Might be quicker than a consumer proposal, but consequences are more severe.

Consulting a Licensed Insolvency Trustee can help you determine which option is best for your financial situation.

Opting for a consumer proposal comes with several benefits:

- Debt Reduction: You often repay only a portion of what you owe.

- Asset Retention: Unlike bankruptcy, you typically get to keep all your assets.

- Fixed Monthly Payments: Set monthly payments make budgeting easier.

- Interest Freeze: In most cases, interest stops accruing once the proposal is filed.

- Creditor Protection: Once filed, creditors cannot take legal action or continue contacting you for payment.

A consumer proposal will have an impact on your credit. In Canada, it’s recorded as an R7 rating on your credit report and remains there for three years after the proposal is completed. Although this is a negative rating, it’s considered less severe than the R9 rating associated with bankruptcy.

To be eligible to file a consumer proposal:

- You must be insolvent, meaning you can’t meet your regular debt payments as they become due or your liabilities are more than your assets.

- Your total debts, excluding mortgages on your primary residence, should not exceed $250,000.

- You must be able to demonstrate an ability to make the monthly payments under the proposed agreement.

- It’s only for individuals, not businesses.

The steps to file a consumer proposal include:

- Consultation: Meet with a Licensed Insolvency Trustee to discuss your financial situation.

- Proposal Creation: Together with your trustee, draft a proposal that outlines the terms of repayment to creditors.

- Filing the Proposal: The trustee will file the proposal, which offers legal protection from creditors.

- Creditor Voting: Creditors have 45 days to accept or reject the proposal. If the majority (by debt value) agree, all are bound by it.

- Making Payments: Once accepted, begin making monthly payments as agreed.

- Completion: After all payments are made and terms are met, the remaining debt is forgiven.

Remember, throughout the process, your Licensed Insolvency Trustee will guide and support you.

How to Start?

Call us today for your FREE consultation.

From our first contact we try to find the right debt management solution for you and your family, we follow through and help every step of the way to financial health and a balanced budget.