Holding Proposals

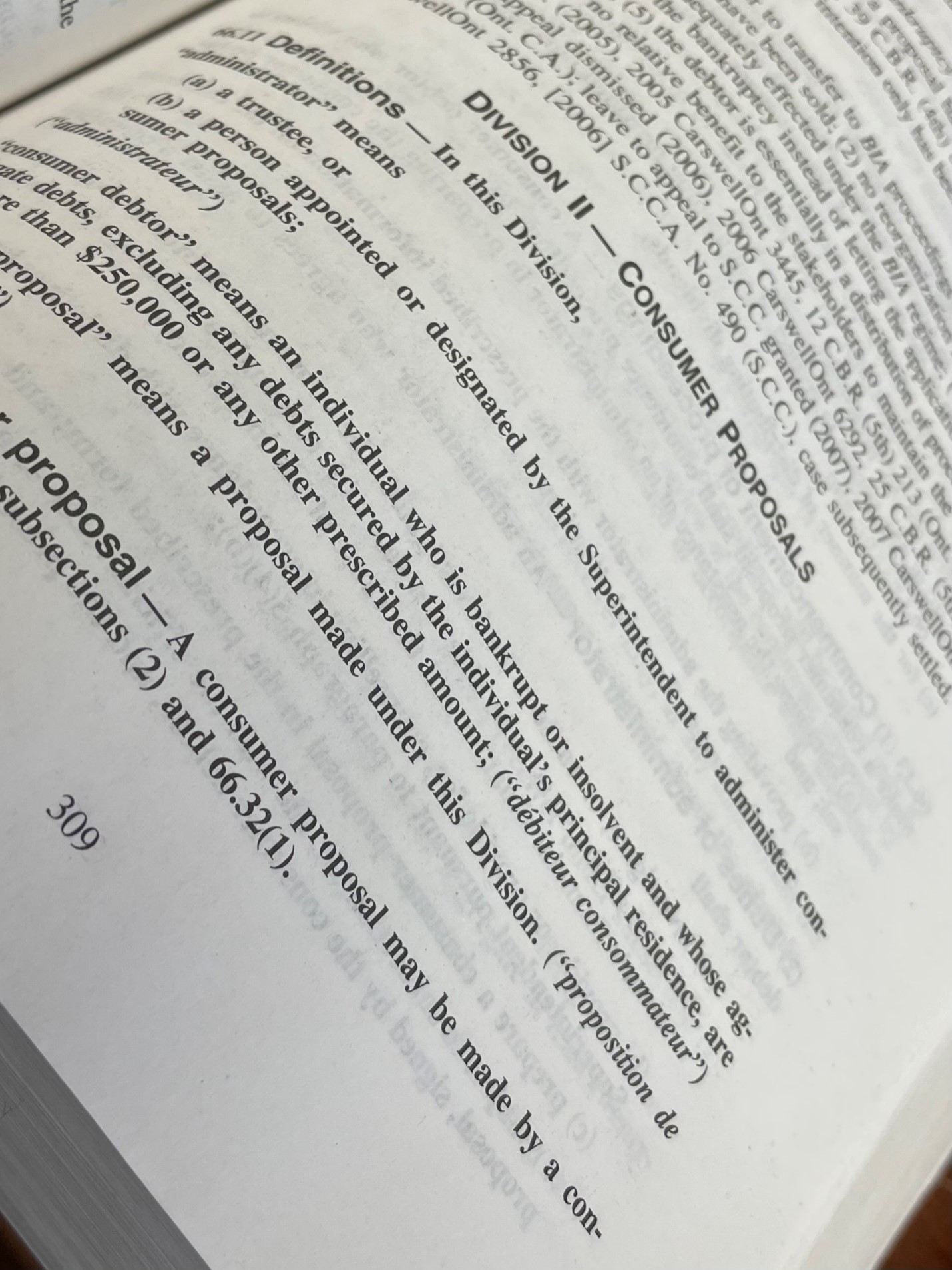

The term “holding proposal” basically means to make an offer to pay your creditors some amount of money – either full payment or a percentage of the face value of the debt – at some future time. Assuming the amount of debt that would be subject to the proposal would be less than $250,000, and the proposal must be completed with 60 months.

A form of holding proposal that is becoming more common is one that entails the sale, transfer or refinancing of real property. You may have recently renewed your mortgage (for a five-year term) and be subject to a significant penalty that makes it impossible or challenging to refinance to repay other debt. But you can make a proposal to your creditors saying something to the effect of:

“the debtor will make one single lump sum payment in the amount of $X.00 upon sale of the family home, or at the time of refinancing when the mortgage becomes due”

If accepted by the creditors, and such proposals frequently are, the holding proposal provides a great solution to immediate debt problems by allowing the debtor to free up cashflow for basic living expenses until the terms of the proposal can be fulfilled.

To learn more and see if a holding proposal is right for you call: 519-646-2222

[wp_call_button btn_text=”Call Us Today” btn_color=”#0f59fa” hide_phone_icon=”yes”]