Category: Tips for Money Management

Mortgages Aren’t Investments—They’re Life Strategies

Mortgages aren’t investments, at least not for you they aren’t. If you are refinancing your home, and not paying off your mortgage, you are doing it all wrong.

Read moreCanada’s Housing Illusion: Aging Homes, Overvaluation, and the Debt Burden

Canada’s housing illusion is a topic that frequently arises and is a very real challenge for all Canadians.

Read moreThe Short-Term Mortgage Problem

Mortgages Are Becoming Dangerous—And It’s Time We Face the Consequences

For decades, mortgages were considered the bedrock of homeownership and financial stability. But today’s mortgage system has drifted far from its original intent. Beneath the reassuring language of “equity” and “investment” lies a network of financial practices that are eroding personal security, inflating the housing market beyond reason, and setting the stage for long-term economic harm. If we don’t change course soon, the damage may be impossible to undo.

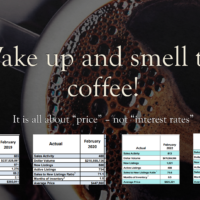

Read moreHouse Prices & Insolvency

House prices & insolvency filings have a tragic relationship, houses are the single largest purchase that the majority of people will purchase on credit. The government has put various protocols in place to provide some modicum of protection for consumers against aggressive lenders. However, even these measures have done little to help. In February 2019 […]

Read moreMore Debt is NOT the answer

More debt is not the answer, when the government is offering you more debt or some form of self-liquidation you should be looking for alternative solutions.

Read moreWhat’s the point in budgeting?

Think about it, what is the point in budgeting unless your spending is out of control, or you have no idea where you money is going? The people who would benefit most from budgeting are the wealthy, those with superfluous income and spending control problems.

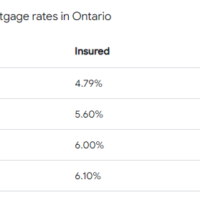

Read moreRates, Prices, and Wages

Change your focus, shift your priorities for home ownership. Rates, Prices and Wages are in reverse order, currently rates remain at an historic low, prices are far too high and wages way to low.

Read moreBudgeting Perspectives

Budgeting can be used to help you plan a strategy to deal with problem debts. It is important that your budget is a fluid, fluxuating tool that helps predict future spending events.

Read moreCommunity Resources

There comes a time for all of us when we need some help, but which way to turn – we hope this short guide provides useful contact information.

Read moreMortgages

Mortgages are investments for mortgagees (lenders) they can be a curse for mortgagors (borrowers). Some mortgages are simply highly charged emotional debt traps for consumers. After all, if your car were heavily leveraged you might sell it and walk for a while, but selling your house means you have nowhere to live.

Read moreReduce Debt by 85%

Consumer Proposals are a great way to reduce the face value of your debt. It is possible to save 85% or more off the total amount of your debt.

Read moreDebt Trap – exaggerates inflation

Many Canadians are living in a debt trap, Candians of all ages and income levels are impacted by the enorrmity of consumer debt – we have a solution.

Read moreHow to Avoid Bankrupt – some strategies to consider.

While bankruptcy is not the only option we offer people struggling with debt, it is understandably the option that people want to avoid the most.

Read moreWealth and Savings – where did it all go:

The media has been rife with stories about Canadian wealth accumulation, how much of the hyperbole is just smoke and mirrors? You may feel well off because your house is worth twice as much as you paid for it – but let’s talk after you’ve sold it!

Read moreBudget Cutting – Expense Categories

When it comes to budget cutting, as prices continue to escalate, make sure you are cutting the proper expenses.

Read moreKick the debt habit

The best way to kick any habit is to develop a new habit to replace it. We can help you understand how and why you were vulnerable to getting into debt and we can help you get out of debt – call us 519-646-2222

Read moreHow do I get my credit back?

We have posted a lot of articles on this topic – this one takes a slightly different view and asks you to think a little more about how you should use credit and why you need it in the first place.

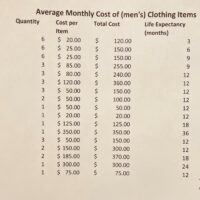

Read moreWear it all goes – clothing costs

Budgeting can be a very useful tool – for some families budgeting is more challenging than for others. Wealthy families don’t really care about budgeting as long as the inflows are greater than the outflows. Poorer people need to pay more attention to their monthly spend.

Read moreDebt Reset – and Build Back Better

Reset your debt and build back better – start again, fresh! No more debts, build assets instead.

Read more