Division One Proposals for Small Businesses

Division One Proposals are very useful tools for small business owners. The criteria for filing a Division One Proposal is that the debtor, if an individual, must owe more than $250,000, excluding a mortgage on a principal residence. If the debtor is a corporation, it may not file a Consumer Proposal, which is filed under Division Two.

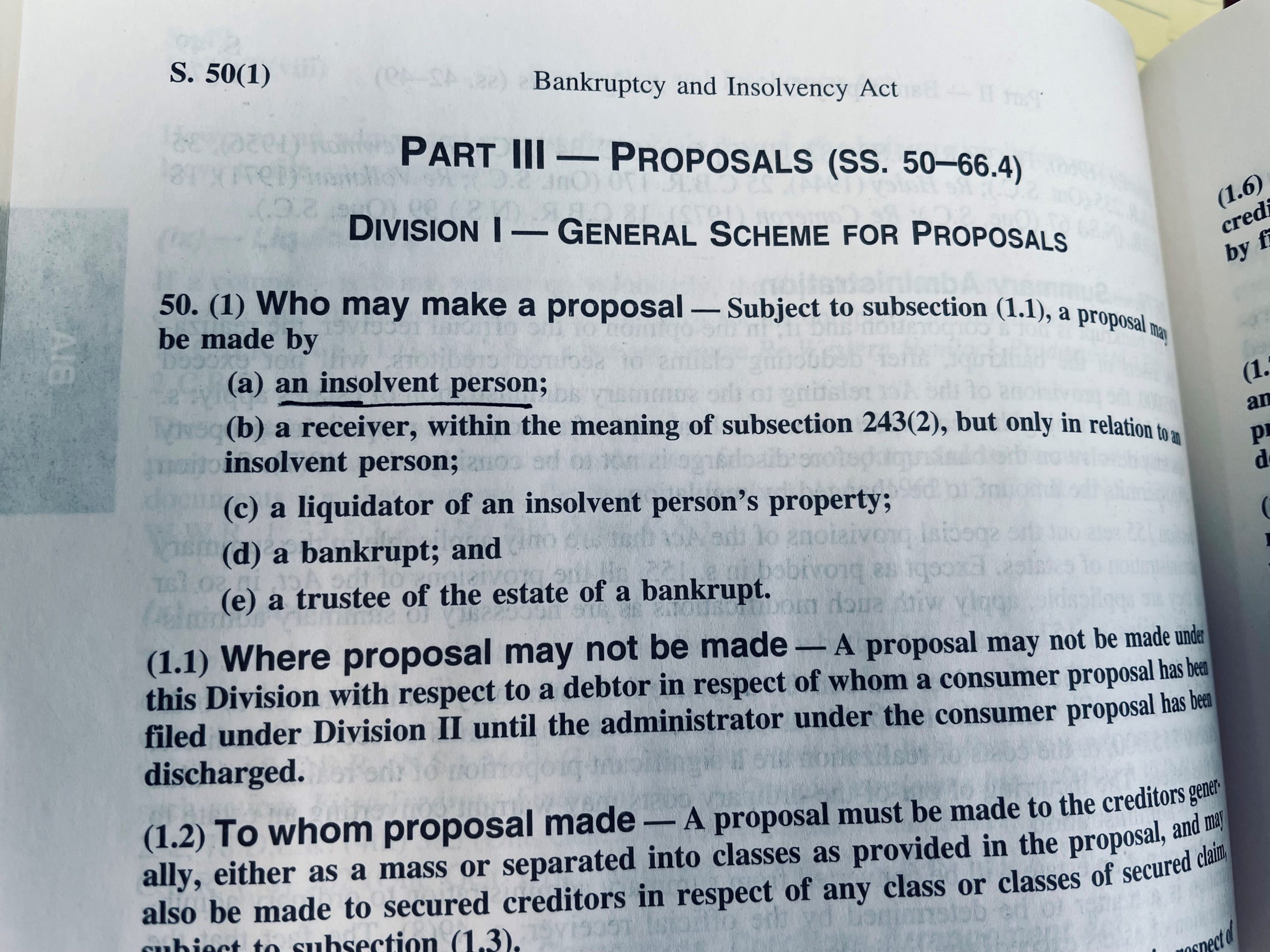

A Person

The Bankruptcy & Insolvency Act (“BIA”) allows Division One Proposals to be made by a person, or a combination of persons, the definition of “a person” in the BIA includes:

a partnership, an unincorporated association, a corporation, a cooperative society or a cooperative organization, thesuccessors of a partnership, of an association, of a corporation, of a society or of an organization and the heirs, executors, liquidators of the succession, administrators or other legal representatives of a person; (personne)

An Insolvent Person

The BIA defines an “insolvent” person as:

a person who is not bankrupt and who resides, carries on business or has property in Canada, whose liabilities to creditors provable as claims under this Act amount to one thousand dollars, and

- (a) who is for any reason unable to meet his obligations as they generally become due,

- (b) who has ceased paying his current obligations in the ordinary course of business as they generally become due, or

- (c) the aggregate of whose property is not, at a fair valuation, sufficient, or, if disposed of at a fairly conducted sale under legal process, would not be sufficient to enable payment of all his obligations, due and accruing due; (personne insolvable)

Joint Proposals

In a case, (referenced as Re: Nitsopoulos (2001). 25 C.B.R. (4th) 302, 2001 Carswell Ont 1994 (Ont. Bktcy.)) justice Farley decided that two individuals who were not partners, could file a joint proposal and could lump their unsecured creditors into one class, whether the creditors were creditors of one debtor or the other or were creditors of both. This ruling was upheld by Registrar Sprout if Re: Howe (2004).

Therefore, it is possible for more than one party to file a joint Division One Proposal. Normally, joint proposals are made by related parties, although the court does not seem to believe that relationship is a necessary precondition for filing a joint Division One Proposal.

Related Persons

Nonetheless, related parties are defined in Section 4 of the BIA:

(2) For the purposes of this Act, persons are related to each other and are related persons if they are

- (a) individuals connected by blood relationship, marriage, common-law partnership or adoption;

- (b) an entity and

- (i) a person who controls the entity, if it is controlled by one person,

- (ii) a person who is a member of a related group that controls the entity, or

- (iii) any person connected in the manner set out in paragraph (a) to a person described in subparagraph (i) or (ii); or

- (c) two entities

- (i) both controlled by the same person or group of persons,

- (ii) each of which is controlled by one person and the person who controls one of the entities is related to the person who controls the other entity,

- (iii) one of which is controlled by one person and that person is related to any member of a related group that controls the other entity,

- (iv) one of which is controlled by one person and that person is related to each member of an unrelated group that controls the other entity,

- (v) one of which is controlled by a related group a member of which is related to each member of an unrelated group that controls the other entity, or

- (vi) one of which is controlled by an unrelated group each member of which is related to at least one member of an unrelated group that controls the other entity.

- (b) an entity and

(3) For the purposes of this section,

- (a) if two entities are related to the same entity within the meaning of subsection (2), they are deemed to be related to each other;

- (b) if a related group is in a position to control an entity, it is deemed to be a related group that controls the entity whether or not it is part of a larger group by whom the entity is in fact controlled;

- (c) a person who has a right under a contract, in equity or otherwise, either immediately or in the future and either absolutely or contingently, to, or to acquire, ownership interests, however designated, in an entity, or to control the voting rights in an entity, is, except when the contract provides that the right is not exercisable until the death of an individual designated in the contract, deemed to have the same position in relation to the control of the entity as if the person owned the ownership interests;

- (d) if a person has ownership interests in two or more entities, the person is, as holder of any ownership interest in one of the entities, deemed to be related to himself or herself as holder of any ownership interest in each of the other entities;

- (e) persons are connected by blood relationship if one is the child or other descendant of the other or one is the brother or sister of the other;

- (f) persons are connected by marriage if one is married to the other or to a person who is connected by blood relationship or adoption to the other;

- (f.1) persons are connected by common-law partnership if one is in a common-law partnership with the other or with a person who is connected by blood relationship or adoption to the other; and

- (g) persons are connected by adoption if one has been adopted, either legally or in fact, as the child of the other or as the child of a person who is connected by blood relationship, otherwise than as a brother or sister, to the other.

File a Joint Proposal

At the end of the exercise, it is clear that corporations can file alone, jointly with another corporation or individual or even a partnership – which might be an administrative headache. However, A Division Proposal can help you and your business resolve your debt problems at the same time and through the same proceeding.

Call 519-646-2222 for more information.