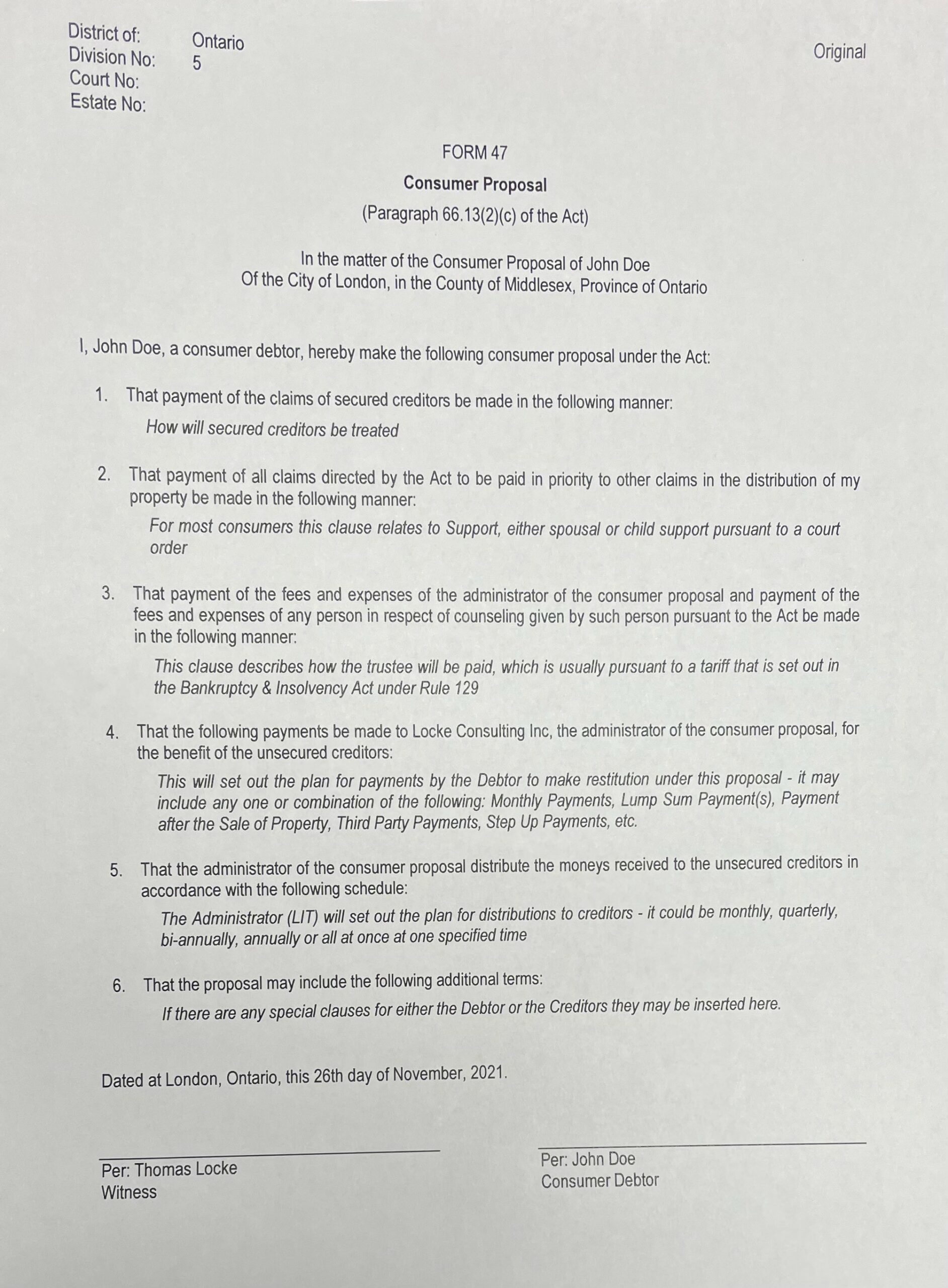

Consumer Proposal – an inside look

Consumer Proposals are surprisingly simple documents, they usually consist of six simple clauses (see the photograph above) that form a binding agreement between the Debtor(s) and the Creditor(s).

Clause 1.

The first clause speaks to how secured Creditors will be treated during the life of the proposal. Usually secured Creditors will continue to be paid in the ordinary course of business. For instance, if you had a mortgage or a car loan and want to keep the house or car you will need to maintain regular payments, or the Creditor will have the right to seize and sell the asset.

Alternatively, if the Debtor no longer wants the asset that is subject a lien this where they will state their intentions. For example, the Debtor may have loans against recreational equipment they can no longer afford to keep – in that case, they will advise the Creditor of their intentions to surrender the asset(s) and allow the Creditor to participate in the proposal for the remainder balance, if any, following the sale.

It is important to note that secured Creditors must have a properly registered, provable, security interest in the asset. It is not sufficient for them to simply say they have a security interest.

Clause 2.

Some Creditors are known as “preferred Creditors” a description of these Creditors is set out in Sections 136(1) and 178(1)(b) & (c) of the Bankruptcy & Insolvency Act. The most common Preferred Creditor(s), for Debtors filing Consumer Proposals, are those with accelerated claims for support arrears pursuant to a Family Court order.

Clause 3.

Near and dear to the heart of every Licensed Insolvency Trustee (“LIT”) is how the LIT will be paid. Rule 129 of the Bankruptcy & Insolvency Act sets out a tariff payment scheme that allows the LIT to draw certain amounts of money to cover fees at certain milestone administrative points. However, the LIT is able to make alternative fee arrangements and may charge more or less than the tariff based on the amount of work they anticipate doing throughout the administration of the estate. The Creditors are advised of what the fee arrangements will be in this clause.

Clause 4.

The fourth clause is where the Debtor makes the actual offer to the Creditors – it sets out the payment terms, advising Creditors of both the amount of money the be paid and the plan to make the payments. Payments can be made weekly, bi-weekly, monthly, semi-annually, annually or as a lump sum. They can be made by the Debtor or by a third party, seasonally adjusted payments can be made if the Debtor is seasonally employed and so on, this is where Consumer Proposals can be creative.

Clause 5.

In this clause the LIT (Administrator) lets the Creditors know its intention for releasing funds – most LITs hold funds in their trust accounts and only issue dividends periodically, that could be monthly, but is more often quarterly, semi-annually or annually.

Clause 6.

The final standard clause allows for the input of any special terms or considerations for either the Debtor or the Creditors. These could be any number of things including, but not limited to, contingency clauses such as what might happen if the Debtor receives an inheritance or a lottery win.

Some LITs do not use the standard format and they are not obliged to do so, but this is the information that, at a minimum, must be disclosed to the Creditors so they can understand what the expectations will be before they vote on acceptance.

The payment terms of a proposal can be quite flexible and are generally limited only by the rules and your, and your LIT’s, imagination. There are not absolutes in filing proposals, we have seen offerings from as low as less than one cent on the dollar all the way up to payments equalling one hundred cents on the dollar plus LIT fees.

Give us a call to learn more about proposals and if a proposal would be a good option for you and your family: 519-646-2222