Wear it all goes – clothing costs

When people are asked about where they spend money the vast majority struggle to accurately depict their spending patterns. There are a lot of reasons why that happens. Back in the olden days, when I first started work, the foreman would come around on Friday morning and hand out manila pay envelopes. The bookkeeper would have written the hours worked, the rate of pay and deductions withheld on the envelope.

We would count our money, to make sure there were no mistakes, before we charged up our wallets for the coming week, until we got paid again. We always knew exactly how much money we had – it was in our pockets. Back then not everyone had bank accounts, why would you need a bank account if you were going to spend your pay anyway?

Things are different for people today – we all have bank accounts, oftentimes more than one, bankers talk us into chequing, savings, mortgage, and a myriad of other (usually unnecessary) accounts – each carrying fees. Sometimes one account is tied to another, for instance your line of credit may be set up as a “savings” account that is tied to your chequing (operating) account so if you overspend instead of going into overdraft you dip straight into your line of credit.

Then of course, we must be mindful, there are nearly four, bank issued, credit cards for every adult in the country. Credit card payments often come directly out of your bank (chequing) account which in turn may come from your line of credit. Add into that mix that many bills are automatically paid from your bank account or pulled from your line of credit at various times of the month. That makes it really hard to track just exactly how much money you have at any given time.

When speaking with clients about budgeting and money management we often talk about semi-fixed (recurrent) expenses, the type of things we don’t usually think about but spend money on anyway. My three top examples are Xmas, vehicle repairs and clothing expenses. These expenses come up every year and will require some forethought to avoid going in the ditch.

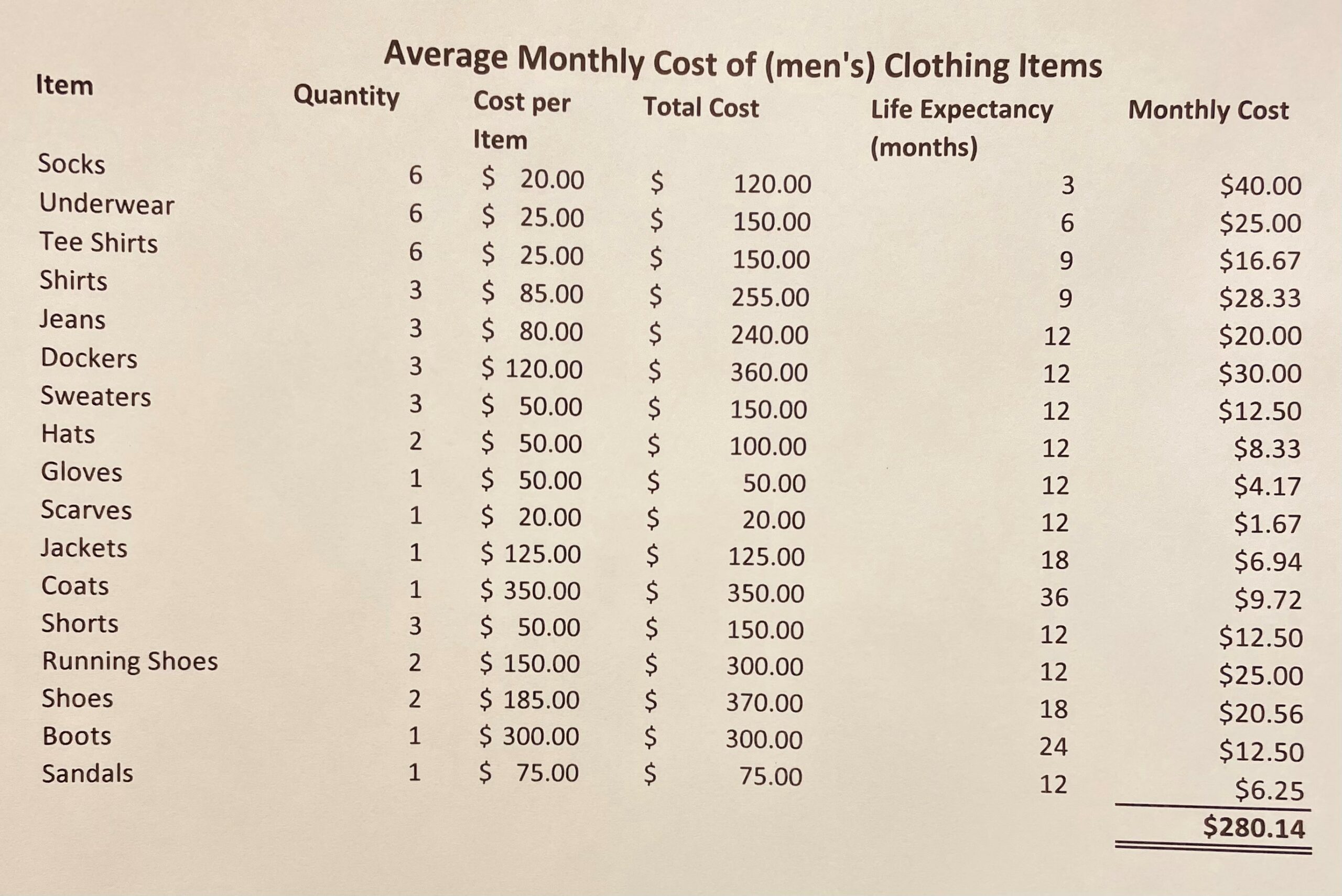

Now to the photograph accompanying this blog article – we were chatting in the office about men’s clothing and how much it costs as well as how long it lasts. We assumed the average wear and tear and the average clothing needs as well as life expectancy (of the clothing items) and a mid-range cost. Our bottom line is $280.00 per month for men’s clothing, to say nothing of other family members. Now, there are some folks who are going to say: “but I always buy at the Thrift Store” or “I make do for longer” or even just “wow, I never thought of it that way”.

Even if you halved our figures that is still a significant monthly budget item and while that doesn’t tell you exactly “wear” it all goes it does give you something to think about as you consider what your real monthly living costs are. Now give some consideration to other, smaller, more trivial, monthly expenditures like “eating out” – pull that monster out of the depths of denial and see what you are really spending on junk food, be honest with yourself, start with a coffee a day at $2.00 each ($60.00 per month) build in the muffins, cookies, burgers, pizzas, chocolate bars and so on.

Try to have fun with your budget, talk to family members, share real costs and call each other out when in denial. Then work on eliminating excessive reliance on credit to back up your paycheque. If you need help figuring this stuff out just call for a free budget review. 519-646-2222