CBDC – Central Bank Digital Currency

Like it or not, CBDC is coming soon. But let’s face it, Canadians are no strangers to using another form of digital currency, ushered in with Canada Trust’s famous Johnny Cash Machines. Initially you could only withdraw cash, then deposits were added, and gradually other banking features were used on the ATMs.

Nowadays you can do most of your banking remotely, either from your home computer, mobile device or at an ATM. And there are so many Point of Sale (“POS”) systems around that most of us use debit or credit cards for everyday transactions, and very few people rely on cash for many expenditures. SO, what’s the big deal?

Why CBDC:

One reason was made evident during the Truckers’ Protest in Ottawa, government imposed behavioural modification. Another is that by eliminating cash, banks also eliminate the Fraction Reserve requirement. But there is far more to it than that!

Speed of processing is a definite advantage, under the CBDC model, transfers will be immediate, ending the lug on transfers between debit card users and merchants receiving funds. On average after money leaves your account at the POS it is held on average for three days in an escrow account before the merchant receives the funds.

CBDC can be used for people on social assistance and controlled by the government to ensure the funds can only be used for designated purposes, rent, food, and other necessities. It could also be used to prevent people from over-spending on alcohol, drugs or even gasoline (if they have a traffic infraction).

China has used their Social Credit DC for economic stimulus by placing credits in users’ wallets and setting time limits for the funds to be spent. For example, the Government could stimulate the economy by adding $1,000 to everyone’s digital wallet on Monday morning and allowing the credits to be available until Friday at 5:00 pm, by which time it must either be spent, or it disappears from the wallet.

Debt Provides Impetus:

Banks have been lending like drunken sailors for decades. In Canada, there are more than 80 million Bank issued credit cards in circulation – with annual charges topping $600 billion. The Canadian Bankers Association have obfuscated their credit cards statistics since 2019, the last report from 2018 is still available on the “way back machine”.

Debt continues to plague consumer markets as well as banks themselves. Currently there is only about $115 billion of actual Canadian currency in circulation, far less money exists than banks have been able to lend with creative, Ponzi like, accounting principles.

Canadian banks have been back loading mortgages, as they gazunder borrowers on renewal (something that does not happen in the USA) – solely in order to prevent defaults (because it in no way helps borrowers) banks have extended the life of mortgages for 25-40 years.

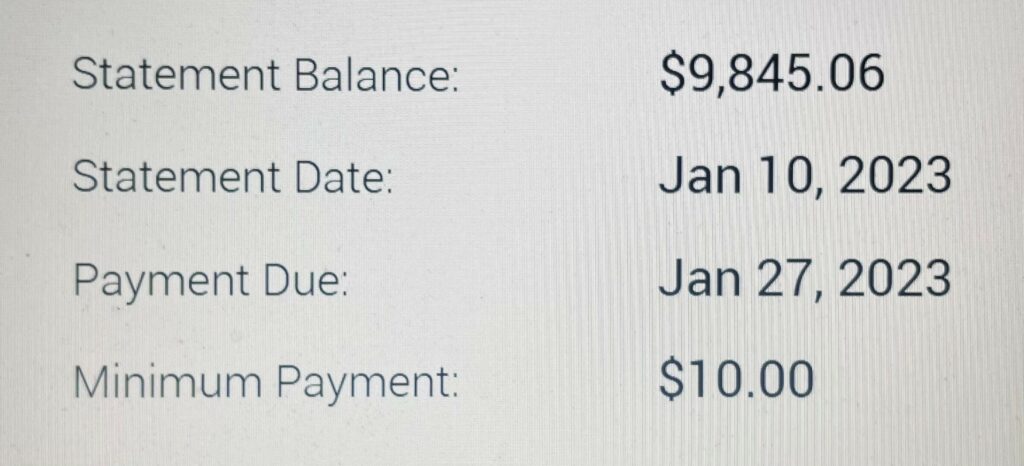

In the USA, Fanny Mae and Freddy Mac, are implementing a policy of charging higher interest rates for people with good credit ratings and lower rates for people with poor credit ratings. Minimum monthly payments have been lowered to $10, on credit card balances of nearly $10,000, see photograph below from RBC VISA statement, and banks have provided more credit facilities (including raising credit limits) to facilitate payments from one form of credit to another to avoid defaults.

Restrictions have also been imposed on funds withdrawals (the use of cash) with bank clients discouraged from withdrawing cash. In Europe, Christine Legarde, the head of the IMF, has been rolling out CBDCs across Europe, with significant consequences for end users.

Canadian banks are steering customers towards buying bank bonds instead of adding equities to investment portfolios. This strategy is related to the government’s 2016 bail-in legislation – by investing in bank bonds, the bank’s asset portfolio increases in value.

The Fed has been pouring hundreds of billions of dollars into failing US banks, while other banks around the world continue to falter. All of these banks are completely overleveraged, and have loaned far money than exists, usually based on future expectations of payment (effective cashflow).

Bank loans were originally predicated on carefully calculated risks of loss versus ROI, following the Great Depression quantitative easing derived from using a widespread fractional reserve banking model. Later asset based lending – lending based on receivables – was final straw for bank liquidity.

The conclusion is that banks are under extreme pressure to redefine themselves, to create a new form of currency, to implement a “great reset” before a complete economic collapse happens.

CBDC and the CRA:

Interestingly, although the government, using CBDC, will have absolute control over your money, being able to control the flow and even the usage of funds through your account, they still keep hiring workers for the CRA.

One might then ask, “why do we need the CRA to collect taxes?” when the government has the ability to help themselves to any amount deposited to a digital wallet? A national tax collection agency would seem to serve a significantly reduced function. CBDC and restrictions imposed on the use of cash will effectively wipe out the underground economy.

Interestingly, the zeitgeist towards globalism also includes a goal of having a united global tax system. As we can see there has been a tremendous uptake of this idea, especially in European countries.

CBDC & Bitcoin:

From the earliest discussions, the Bank of Canada has said they will not allow Bitcoin and other, private, digital currencies to be recognized for day to day use – albeit they will still be available for investment purposes. So don’t conflate your bitcoin with CBDC. And, in case you wondered, Bitcoin is traceable.