Rates, Prices, and Wages

Rates, prices, and wages are the three most important considerations in housing affordability – in reverse order. Canadians have been conditioned by the media to think about those three factors in the wrong order. Everyday some news article will rattle on incessantly about interest rates being too high, there’s a fleeting mention of pricing but nary a thought to wages.

RATES:

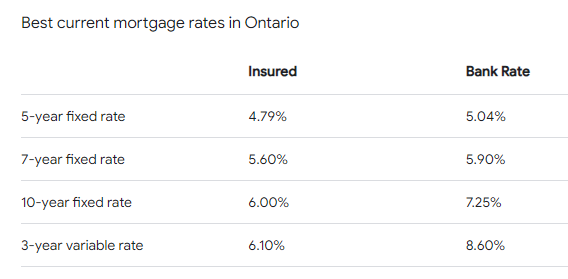

Historically, the average mortgage rate in Canada is 8% – today banks are offering rates at 5% that is almost 40% lower than historical averages. Rates are incredibly low and have been for the past 15 years – a great time to pay off your mortgage is when rates are low since more of your income goes to eliminate debt and future interest payments.

PRICES:

In 2013 the International Monetary Fund (“IMF”) declared that Canada’s housing was overvalued by 60%. This from the Realtor’s Association of Hamilton and Burlington;

“The average price of a residential property in 2021 was $867,560 across the RAHB market area. This is up 25.74 % from 2020. The average price in 2011 was $321,449 which represents a 169.89 % increase over ten years.”

Yet, out of FOMO (“Fear of Missing Out”) and not logic, Canadians gleefully overbid asking prices for more than two consecutive years. The FOMO was fueled in part by Realtors urging bidding wars to drive up commissions. Poorly regulated lenders were throwing speculative money around, as if it grew on trees, to people who two years earlier would not have qualified for any mortgaging.

WAGES:

The most important of the three considerations is wages, in 2019 the CRA reported that the “average” (mean) Canadian income was $59k but the 2022 average was a mere $54k a drop of $5k over three years. It is estimated that some 21% of Canadian workers earn $100k or more per year. that equals about 7.5% of the total population.

The government, through Statistics Canada, fondly touts misleading information to suggest that the country is better off than it is – using such statistics as “Household Income”. Household income is inclusive of all people living at one address, and in 2024 we are seeing far more immigrant populations with more family members in the household as well as more multi-generational family units.

Traditional households have changed dramatically under the pressure of inflation and now we see more middle-aged couples creating “granny suites” to accommodate aging parents as well as adult children remaining in the home for longer. These factors contribute to a significant increase in household incomes.

Let us know what you think:

Do you think you can afford to buy a new home at todays low interest rates? Do you hope that prices continue to soar, or would you prefer to see them drop? Are you comfortable with your income, do feel that you afford to live without access to credit?