Debt Slavery in Canada

Modern slavery in Canada has been a topic of discussion for the UN and the media, employment slavery has been widely reported and involves the subsidizing of temporary foreign workers, in an apparent effort to push down on wages for domestic employees, as a form of corporate welfare. However, debt Slavery is the main topic we will be delving into in this blog.

Nonetheless, let’s take a cursory purview of the way in which corporations and governments have historically manipulated public opinion to protect their own interests (one really not need to go further back than the events of 2020). The most prosperous period in human history was between the end of WWII and the early 1970s. For the first time in human history, women with children did not need to work, they could stay at home to tend to family activities since only one income was required to support the family.

The new luxuries that ordinary people experienced included Defined Benefit Pension Plans, geared to inflation pay increases, as well as employer funded health and welfare benefit plans. These additional costs were offensive to large corporations and eroded their profits, lobbyists complained to Congress, which during the post war era was very protectionist and nationalistic. The solution, the CIA and corporations funded the “Women’s Liberation” movement – apparently Rosie the Riveter was quickly forgotten – women took to the streets, urged on by the likes of CIA cut outs like Gloria Steinem to ironically demand a return to work.

Source Wikipedia: In the late 1950s, Steinem spent two years in India as a Chester Bowles Asian Fellow. After returning to the United States, she served as director of the Independent Research Service, an organization funded in secret by a donor that turned out to be the CIA. She worked to send non-Communist American students to the 1959 World Youth Festival. In 1960, she was hired by Warren Publishing as the first employee of Help! magazine.

The result was almost a doubling of the labour pool which allowed corporations to push down on incomes and benefits to the middle class. The middle class is again under assault by the same type of collusion between governments and corporations with massive, often illegal, immigration and the creation of the Temporary Foreign Worker Programme which is providing taxpayer funded incentives to corporations to hire subsidized employees pushing down on incomes. These programmes are the ones identified as problematic by the UN (see link above).

Ironically, since the advent of Reganomics and Thatcherism in the UK, more tax loopholes have been created for the very wealthy (including corporations) who easily evade paying their fair share of taxes through a variety of government endorsed programmes including using foreign company registrations (such as Meta) in Ireland to avoid paying taxes. Bill Gates is probably the most prolific tax evader who uses his “charitable foundation” to funnel his income through “tax free donations” which are then, controlled and directed by Bill Gates to make donations to countries that will be influenced to assist in his well documented monopolism. The notion of “trickle down economics” although cleverly packaged and sold to the populace is an abject failure for humanity.

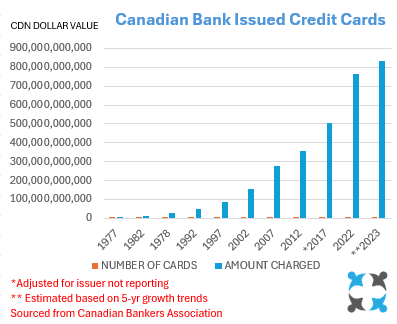

Let’s now refocus on the evolution of debt in Canada, by discussing Bank Issued Credit Cards (“BICC”). In 1977, when the Canadian Bankers Association (“CBA”) first started recording credit card data there were relatively few credit cards in circulation and they were being used quite judiciously.

The average charge was sufficient to purchase two full tanks of gasoline, by comparison the average charge today would barely purchase half a tank. In 1977 BICCs were required to revolve (be paid down in full) at least once annually or charging privileges would be suspended. Additionally users had to justify an increased credit limit to their bank Account Manager, and, minimum monthly payments were at or about 5% of the outstanding statement balance.

In 1977 only about one in three (3) Canadians had BICCs. Also in 1977, having a steady income and a clean credit report were both important qualifying criteria, to obtain a BICC. Rolling forward to 2024 the statistics have changed tremendously, now, there are enough BICCs in circulation for every Canadian to have about three (3) BICCs – a complete reversal of the 1977 picture, we have gone from 8 million to about 100 million BICCs in circulation.

The minimum monthly payments on BICCs have plummeted to insanely low levels, begging for regulatory intervention. A RBC BICC with a monthly balance of $10,000 requires a “minimum monthly payment” of ten dollars – that’s right a mere ten bucks! Meanwhile the average BICC interest is calculated at 21%. All banks are using the same miniscule payment schemes to keep consumers in debt shackles – in one instance we saw a CIBC statement that calculated minimum monthly payments over a period of 420 years – that was no typo “four hundred and twenty years”.

In fact, based on statistics reported by the Canadian Bankers Association in 2019 (for the year 2018), we have estimated that Canadians are charging about eight hundred and fifty billion ($850,000,000,000.00) on BICCs each year. To add perspective to the gravity of this situation the amount of money charged each year on BICCs probably exceeds the (after tax) disposable income of all Canadians combined.

Statistics, as we are aware, are always manipulated by politicians as well as businesses that derive a benefit from creating a misleading impression of data that may inure a benefit to them. For example, the authors of one online article reported the average Canadian salary for 2023 was $64,850, without more information to validate that calculation it seems unlikely. Let’s break it down and see why their data may not be an accurate reflection of incomes.

First of all not everyone gets a salary, a large percentage of the workforce receives a wage so if their data was based on fixed salaries that may well be the case. Secondly, there are only 16.5 million full time employees in Canada, and finally the definition of full time employment includes anyone who works more than 30 hours per week, and includes a combination of any variety of gig jobs (Uber, Pizza delivery, part time office cleaning).

According to the CRA, slightly more than 32 million Canadians filed income tax returns for the tax year 2023. Statistics Canada reports that for the tax year 2022 more than 32 million tax filers reported income of slightly more than $1.7 trillion which equals an average income (if everyone were to receive the same amount) of $53,125.

Although not an accurate measure of how much tax Canadians pay, the Fraser Institute estimates that by June 13th all money earned will be going toward taxes of some description. Using that calculation, 45% of our income goes into some form of taxation leaving income earners with an average annual disposable income of a mere $22,906.

Clearly, consumers are probably charging more on BICCs than they earn in after tax dollars. Importantly, that is just credit cards, in addition to which, according to CMHC, Canadians owe about $2.9 trillion on residential mortgages. However, that number may not include secured lines of credit or private mortgages that are not reported in bank statistics, vehicle loans, finance company loans, payday loans and other forms of debt are also not be calculated in the total.

Debt slavery is on balance one of the worst kinds of indenture that people in a modern society can be subjected to. Debt literally destroys life outcomes, and at bottom the only beneficiaries of massive quantities of debt are the lenders. Banks and credit reporting agencies tell us that up to 70% of consumers pay their BICC balances in full every month, which would mean that Canadian income earners only have access to a fraction of their income to (fully) pay for any goods or services. However, this too is taking liberties with facts in that banks issue statements on the 14th day of each month, with the payment due date being the 28th. Accordingly, even if the the consumer pays the full balance on the 28th they are already half a month deep in new BICC charges.

Breaking the chains of debt seems to be a relatively easy thing to do – and it is – just file for bankruptcy or a make a proposal. That takes care of debt that is existent at the time of filing, however, inflation has made living in Canada unaffordable, and lenders are pushing debt products into already saturated markets, including desperately targeting new immigrants with loans, lines of credit and BICCs with the only qualifying criteria being that they have arrived in Canada, without citizenship, during the past five years.

BICCs are one of the most egregious forms of debt exploitation, in part because they are ubiquitous and also because the cost of everything purchased increases exponentially because of their use. When you use a credit card, the issuer (bank) needs to suck out a profit, as does the card company (VISA, MC, AMEX, etc) and the merchant has to pay a fee for the convenience all of which are ultimately passed along you, the consumer.

I once read that the average direct cost of using credit cards is 6% of the purchase prices of the goods purchased – however, very few merchants will give a 6% discount for cash purchases, so even cash buyers are being exploited by higher prices for goods and services. In addition to the point of sale costs, most cards charge consumers annual fees just for having the card account.

The solution is a paradigm shift in the way that money is loaned and the creation of more rules and regulations to curtail exploitation. Currently Canada’s GDP is estimated to be $1.89 trillion, that number is artificially bolstered by clever statisticians, nonetheless one need not be a mathematician to see that even without the addition of the $1 billion per week that is paid on interest for the national debt Canadians have become ensnared into debt slavery.

Living debt free is far challenging than becoming debt free.