House Prices & Insolvency

House prices & insolvency filings have a tragic relationship, houses are the single largest purchase that the majority of people will purchase on credit. The government has put various protocols in place to provide some modicum of protection for consumers against aggressive lenders. However, even these measures have done little to help.

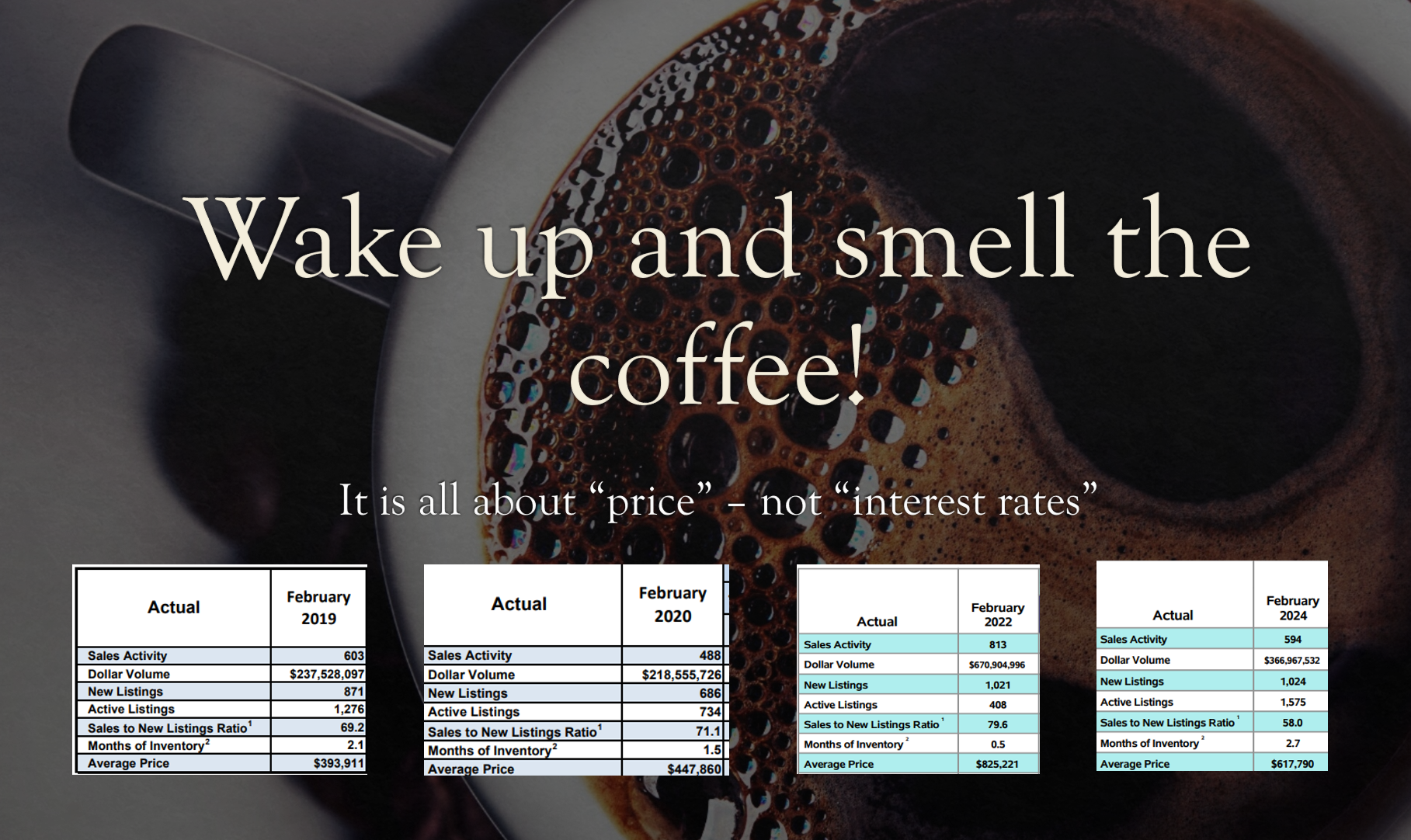

In February 2019 the average house price in the London and St. Thomas market was $393,911, an increase of $44,063 from a year earlier when the average price was $349,848. That represents an increase of about 11% – which is a significant increase relative to incomes that barely moved.

During 2019 many folks seeking mortgages of $200-$250,000 were declined, because their incomes were too low, their debt service ratio was way too high. Banks also had risk aversion as their profits were in serious decline.

By some financial miracle, what else could better explain what happened(?), by 2020 the banks were throwing loans around like cheap candy and consumers were lapping them up. Finally, an opportunity for the most impecunious among us to become a home buyer. February 2020 saw average house prices at $447,860, in the local market.

By the end of February 2022 house prices had exploded to a whopping $825,221 an increase of nearly 200% – meanwhile, according to government data incomes were in freefall. What “happy juice” were the bankers drinking? One might only guess!

By February of 2024 the local market saw a drop of $287,010 to a new average of $617,790 – this wiped out many high ratio borrowers and will still wipe out many more as mortgages come due into 2025 and many homebuyers are wallowing in credit card debt.

We keep hearing the red herring about interest rates which in reality has absolutely nothing to do with the cost of housing. In 1981 people were buying houses as first-time home buyers while rates were 21%. The affordability difference between then and now has everything to do with price and its relationship to incomes – and clearly rates did not enter into the equation.

Unless your income has increased by nearly 300% since 2019 you simply cannot afford the prices today, now is not your time. Rents are slowly coming down and house prices must continue to fall, anyone telling you otherwise can’t do basic maths. House prices are driving insolvency filings up and no reduction in interest rates is going to help.

Canada, in spite of what you might hear in the media, is a global leader in Mortgages in Default, some pundits are saying that we are third behind the USA and the UK – but that is simply not true. Mortgages in default in Canada have risen substantially (about 30% since 2022). It is important to consider metrics when comparing with other countries – in the USA and the UK a mortgage is in default after ONE missed payment, in Canada a mortgage is not reported to be in arrears until it is at least 90 days in the ditch! Sadly, Canada uses a lot of alternative statistics in its reporting, perhaps it is the “new math“.