Inflation is Real

Inflation is real, in Canada, and it is already having a real impact. The government seems happy with allowing inflation to grow while they print money to create the illusion that they are helping people. During the past year and a half, the government has been throwing money around – much of it aimed at low-income people in the form of CERB.

Giving money to people who are in receipt of other benefits, as we have previously blogged, simply creates a series of other problems. Initially, last year, social benefit recipient families received so much money they bought furniture, paid up their payday loans, paid off car loans and lived it up. Then the fear of repayment set in and the government changed the rules, requiring slightly better screening and that a portion of the benefit be withheld for taxes.

The withholding of $100.00 per week, from the $500.00 weekly payout, means that the recipients saw a decrease $433.00 per month – enough to dissuade recipients from buying furniture and other big-ticket items. Symbiotically, prices, of just about everything, have been rising. Food prices have jumped dramatically, lumber and building materials have increase by up to 400% since the lockdowns began.

The government’s carbon tax is no doubt to blame in large part by driving up both production and delivery costs. Mortgage agents/broker, real estate agents/brokers and some builders have seen significant increases in revenues, but few other workers have. Lower income (service) workers are not going to work because they can get paid as much or more money staying at home.

If costs continue to rise, and there is every indication they will, Canada is in real danger of a tremendous economic slide. Housing is becoming unaffordable for many Canadians, not only purchasers but also renters. Even the government’s “great reset plans”, that seem to suggest the government will seize property and rent it back, will provide no viable solution to runaway housing costs.

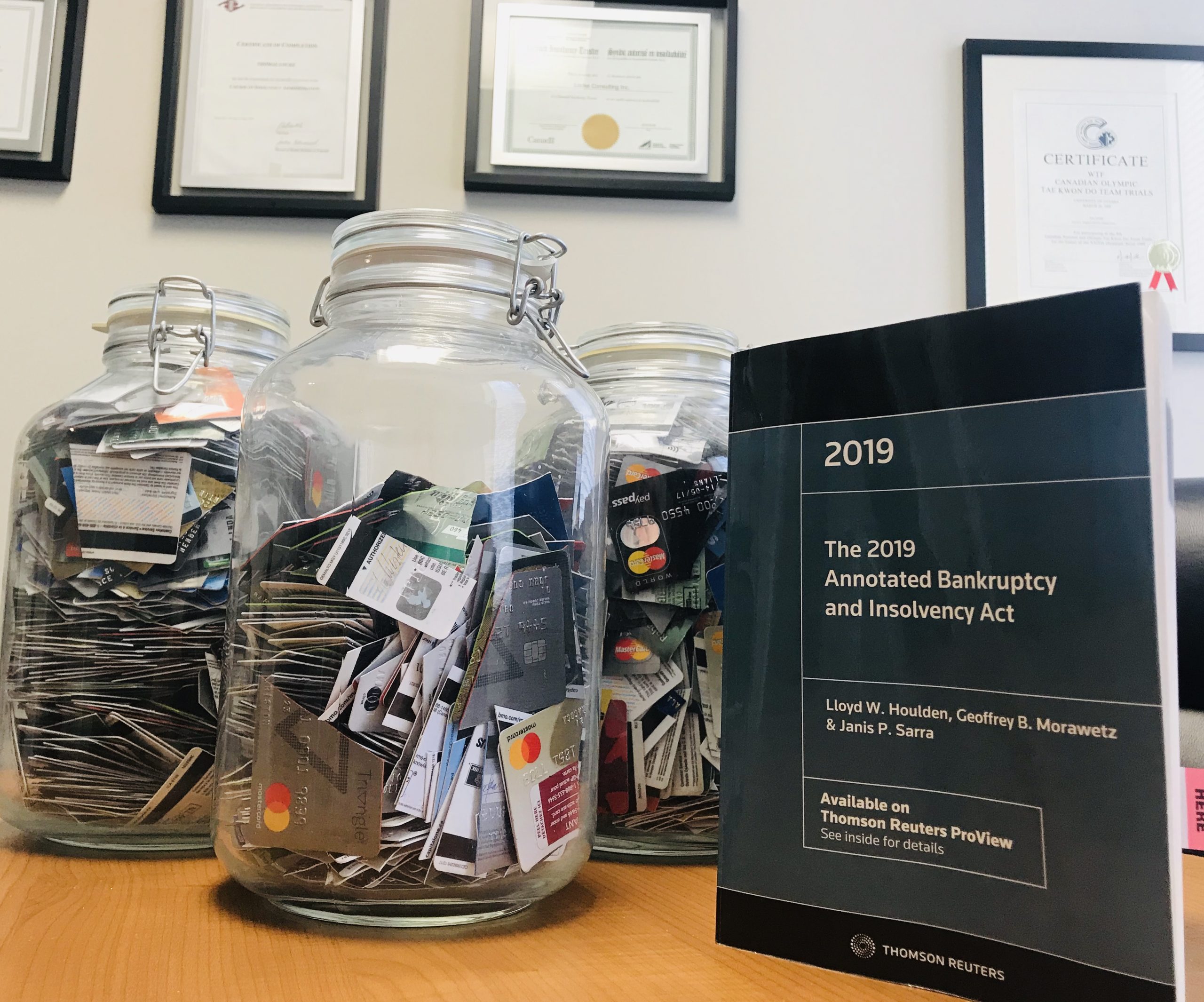

During the lockdowns Canadians have been loading up on debt and not seeking relief. Bankruptcy and Proposal filings are at the lowest level in years, suggesting that debtors are either finding other solutions (re-mortgaging) or holding off to wait and see what will happen next. Many small businesses have been forced to close or to slow down, leading to many owners liquidating assets to survive until a reopening occurs.

If prices continue to rise as incomes remain stagnant, it is possible we may enter a period of hyper inflation, which, itself, could be fueled by the government’s continued handouts. Hyper inflation has been seen around the world in other countries, Venezuela is the most notable country that comes to mind. Even changing from a notionally cash based economy to a virtual currency will bring no salvation, it will just make a slight change in the way that money is recorded and transacted.

What are your family’s plans to deal with runaway inflation? Will you leave the country, will you downsize your home and your lifestyle or will you just wait and see?