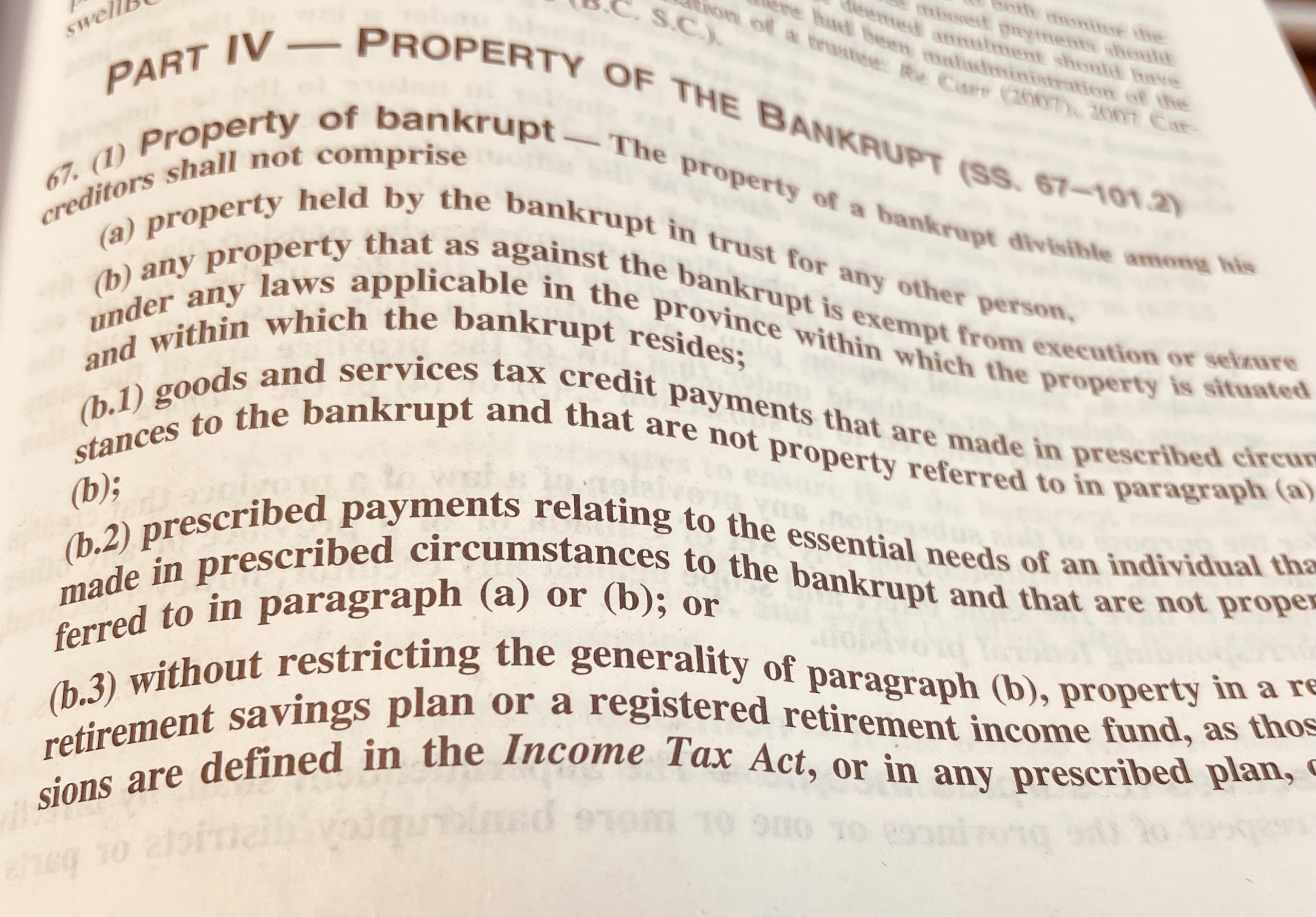

Property of the Bankrupt

Section 67 (1) of the Bankruptcy & Insolvency Act sets out what property of the bankrupt is divisible amongst his/her creditors. Many people live in fear of bankruptcy because they think that they will lose everything they own to the trustee. That is simply not the case.

If you are holding property in trust for another person, that property cannot be seized. An example that we frequently see is where a vehicle is registered in the name of a parent, effectively in trust, for a child in order to reduce insurance costs. Creditors could attack the “trust” but in most cases the value of the vehicle is relatively immaterial, and the matter is dealt with on prima facie evidence. There are many more, and some far more complicated, forms of trust that provide protection for property that is held in trust but that is a topic for another blog.

Federal and provincial laws, aside from the Bankruptcy & Insolvency Act, provide protection for assets that are exempt from seizure. Provincial exemptions vary from province to province while federal exemptions are applied across the country. In Ontario, provincial exemptions, generally, are found in Part II of the Execution Act.

Provincial Execution Acts, typically allow exemptions for household goods and furnishings, clothing and personal belongings, vehicles, tools of the trade as well as a homestead exemption, exempting a portion of equity in real estate (when it is a principal residence. Provincial Insurance and Pension Benefit Acts also confer exemptions on people for insurance policies and pensions monies.

HST or GST payments to individual debtors are not considered to be property unless they are the result of proprietorial business activities. If a sole proprietor of a business receives a business excise tax refund the refund is seizable by the trustee, however, if the refund is related to a personal amount payable as a result of the bankrupt being a low-income earner, they will retain the refund in the ordinary course.

RRSPs, RIFs and LIFs are also exempt from seizure except for contributions made by the bankrupt in the twelve months preceding the date of bankruptcy. If you have been injured in an accident, vehicular or otherwise, and have a claim for personal injuries any amount of compensation for those injuries is also exempt from seizure.

The point being, all is not lost by filing a bankruptcy – you can still go bankrupt and keep most of your day-to-day stuff. Call us to find out if bankruptcy is the right option for you to deal with your outstanding debts: 519-646-2222