The Debt Pool

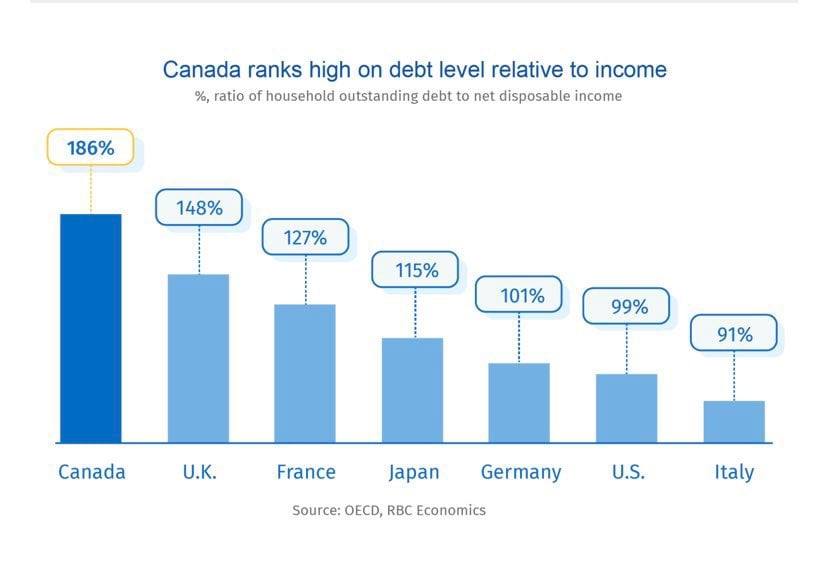

Are you swimming or drowning in a debt pool? Canada’s debt pool is deeper and wider than just about anyone else’s in the world. Few people are able to live in Canada without reliance on access to debt, and the only beneficiaries of the excessive usage of debt are banks.

Revolving Credit

Revolving credit is the vortex that sucks people into the debt pool. Some examples of revolving credit include Lines of Credit, Overdraft Protection and Credit Cards. Revolving credit facilities allow you to both go into debt and get back out of it without having to negotiate specific, situational loans, each time you want to borrow money – that is there advantage and attraction.

It used to be the case that if you had a revolving form of credit you would not be allowed to remain in debt without periodically revolving (paying off) the line. If you did not revolve the credit facility periodically the lender (bank) would simply convert the revolving credit to a term loan with fixed monthly payments until the debt was repaid.

However, times have changed, and have they ever changed – these days lenders, banks particularly, do not want you to be debt free, they want you to remain in the debt pool, as deep and wide as possible, for as long as possible and will do almost anything to help you avoid defaulting on your payments.

Minimum monthly payment requirements on credit cards are not even close to paying the accrued monthly interest. Credit limits are raised to prevent you from hitting the debt ceiling, and other forms of credit are made available to facilitate you using one form of credit to pay for another.

Mortgage Debt

Mortgage debt has been a go-to, in the debt pool, for several years – interest rates have been suppressed for an extended period of time, creating a debt trap. There is no better time to pay off debt than when interest rates are low, low rates are like a lifebelt in the debt pool. Sadly most people see things backwards, they see low rates as a good time to get deeper into debt.

Using mortgage debt to consolidate unsecured debt, like revolving debt, increases and compounds debt over the long haul and usually sucks people even further into debt. Once the revolving debt is paid off, consolidated into a mortgage, it quickly becomes available for superfluous, and emotionally charged, impulse purchases.

Consumer Proposal

A Consumer Proposal is a great option to resolve unsecured debt to throw a lifeline into the debt pool and get you back onto secured footing, but Consumer Proposals are not useful for tackling mortgaged debts.

Have you had enough?

If you have had enough of the financial drain of drowning in the debt pool (carrying more debt than you could possibly ever repay) call the office at 519-646-2222 to explore realistic options for draining the pool and returning to some level of financial freedom and choice.