Blog Articles

Never Co-Sign – Ever!

You should never co-sign any debt, unless you are prepared to pay the whole debt on behalf of the person you are co-signing for. If your kid, or some other family member, needs a co-signer instead of co-signing for them try educating them. The reason a co-signer is required is because the borrower does not […]

Read moreAs Good as Gold

Sayings like “as good as gold” or “real estate values always go up” are well worn fallacies. Either can be an economic trap – especially when fuelled by a fear of missing out!

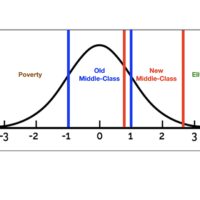

Read moreThe New Middle-Class

The new middle-class has shifted, the old top is now at the bottom.

Read moreReal Debt Relief – Caveat Emptor.

Real debt relief you say? You want real debt relief, not just a band aid solution. Well that is in short supply and here are some of the reasons.

Read morePost Christmas Debt

Post Christmas Debt is like drinking fine wine, it tastes great at the party but leaves a massive headache in its wake.

Read moreMortgage Renewals 2026

Between 20% and 30% of Canadian mortgages will renew in 2026, many tied to overpriced homes bought during ultra-low rate years. Even with historically low rates, monthly payments are set to rise sharply—colliding with inflation, falling property values, and record consumer debt. As defaults and foreclosures increase, borrowers face difficult choices in a rapidly correcting market.

Read moreThere is no such thing as “leverage”

“Leverage” is one of the most abused words in modern finance. Sold as a smart strategy for building wealth, it is nothing more than debt disguised as opportunity. This article exposes how lenders use the promise of leverage—particularly through RRSPs and home buying—to drain wealth from the middle class while locking Canadians into lifelong debt.

Read moreBlame the Banksters not the Boomers.

For years we’ve been told that Boomers are the problem—that they “had it easy,” pulled the ladder up behind them, and are hoarding homes while younger generations struggle. It’s a convenient story, but it’s also wrong. The real culprit behind today’s housing unaffordability isn’t a generation—it’s a financial system engineered to turn shelter into debt and citizens into lifelong borrowers. If you want to understand why housing feels out of reach, stop blaming your parents and start following the money.

Read moreI AM IN DEBT; HOW DO I GET OUT?

LIT’s face this question everyday from consumers – I am in Debt; how do I get out? As we will explore in this blog, the problem is far more obvious than the solution.

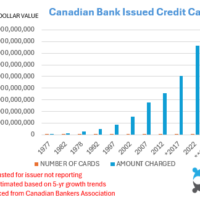

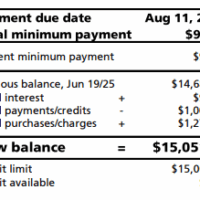

Read moreShocking AI Credit Card Data

Shocking AI Credit Card data tells an important tale. Cut the nonsense of victim blaming, until the banks are meaningfully regulated consumers will wallow in an unextractable debt vortex.

Read moreMeet Gary Stephenson

Meet Gary Stephenson, one of my favourite economists who speaks in simple terms for an unsophisticated audience – us!

Read moreBankruptcy; Costs and Consequences

The costs and consequences of filing for bankruptcy are usually worth it to get you a fresh start.

Read moreLeverage: who’s leveraging who?

Is it leverage or self-liquidation? The two terms are often confused and sometimes used interchangeably but have quite different meanings.

Read moreProposal or Bankruptcy

It’s your choice – proposal or bankruptcy? Your LIT will guide you but not make your decisions for you! In an ideal world you would be able to live without debt.

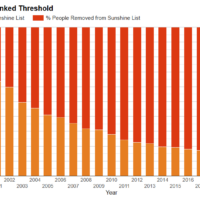

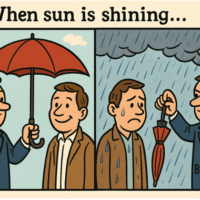

Read moreInsolvency: Bankruptcies and Proposals.

Insolvency is only one part of the solution. When the sun is shining your banker is there with an umbrella, but when it starts to rain he’ll fight you like the third monkey on the ramp to Noah’s ark to get it back.

Read moreYou Can’t have your Cake and Eat it!

When the chips are down that is the time to let go, not to try to hang on!

Read moreMortgage Defaults on the Rise

Recent media reports indicate a 600% increase in Powers of Sale by banks, with private mortgagees also commencing similar proceedings. Other reports note that 1.4 million consumers are in arrears on debt payments. Defaults are inevitable in today’s debt-saturated economy. A significant percentage of the population is entirely debt-dependent, with no realistic hope of repaying […]

Read moreBuying a House is Insanity

The Case for Selling your House

Canadians are desperately clinging to their homes while sinking deeper into debt. For many, the logic simply doesn’t add up—and here’s why: Buying a House Is Not an Investment When you acquire an investment, you do so with the reasonable expectation of growth, along with the flexibility to move from a non-performing asset to one […]

Read moreConsumer Proposals – and social challenges.

Consumer proposals are legal arrangements between debtors and creditors that change how debts are repaid. Typically, a consumer proposal includes all debts and reduces both the principal amount owed and the monthly payment terms. Consumer proposals carry no interest, and the Licensed Insolvency Trustee’s (LIT’s) fees are not added to the payment terms; instead, they […]

Read more