Category: Insolvency News

Hold On – fasten your seat belts

Brace yourselves, the worst is surely yet to come. House porices dropping, pensions disappearing, credit use is at an all time high.

Read morePoverty

“Poverty is the same thing the world over – it sucks” – Jim Kelly (quoted from the movie “Enter the Dragon”)

Read moreInsolvency Recidivism – what causes it?

Insolvency recidivism has increased steadily over the years but it has not increased at the same pace as the volume of debt.

Read moreNo More High Interest – Bill S-239

Bill S-239, if it passes muster will cool consumer lending by reducing interest rates. Some lenders are charging up to the (current) legal interest rate of 60% that will drop dramatically under this Bill.

Read moreConsumer Proposals – FAQ

In this blog we present some “what-if” type of questions and answers regarding Consumer Proposals.

Read moreRecession – is it coming, how will it impact you?

Recessions come and go and threats of recession occur with a much higher frequency than actual recessions.

Read moreBankruptcy – things that increase the costs

The costs and consequences of filing bankruptcy have changed and with those changes fewer people are filing bankruptcy as a means to solve debt problems.

Read moreAfter Acquired Property – Bankrupts Beware

After acquired property includes the increase in value of your home between the time of your bankruptcy and the time of your discharge.

Read moreProposals are popular – almost 80% of insolvency filings are proposals

Proposals have far surpassed Bankruptcies as the consumers’ choice for dealing with debts.

Read moreGoing Bankrupt – where to start

Going bankrupt isn’t hard, completing the process isn’t hard either. The hard part about going bankrupt is making the decision.

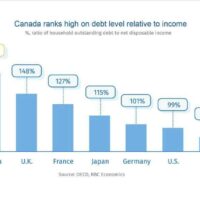

Read moreCanada is number one!

Canada is number one in a lot of things, some of them are not prideful. Debt certainly falls short of something we should be proud of.

Read moreRetirement – sailing off into the sunset

Retirement is something that we all have to think about sooner or later, sooner is better.

Read moreUpdated Forms

The Superintendent of Bankruptcy has updated some of the forms used by LITs – these forms necessitate further questions being added to our application forms. Learn more!

Read moreProposal or Bankruptcy – the pros and cons

Get the skinny on some of the differences between proposals and bankruptcies. Read this article or call us at 519-646-2222

Read moreInsolvency Apocalypse

In the face of ever increasing consumer debt levels, Canadians are betting on their ability to avoid insolvency.

Read more$200 away from insolvency

You are either insolvent or you are not, if you threw a dart at a dartboard and it landed in the triple 2, you would not call that “nearly a bullseye” or “51/2 inches from a bullseye.

Read moreDebt Relief – a phone call away

Real Debt Relief is available to help you regain control of your paycheque and get your financial life back in order. Call us at 519-646-2222 to get started.

Read moreCERB and CEBA overpayments

CERB and CEBA overpayments have been a problem for hundreds of thousands of Canadians. The Regime appears to have settled on treating them in the same manner as other overpayments on government payments.

Read moreTrustee Fees – in Bankruptcies and Proposals.

Trustee fees are a bit of an inigma for people filing a Bankruptcy or Proposal. In this article we break out how the fees are calculated.

Read moreGoing Up – interest rates that is

We have been talking a lot about debt, house prices and excessive mortgaging. It now looks as though interest rates, which have already risen, will increase to threaten consumer financial stability.

Read more