Category: Consumer Proposals

Post Christmas Debt

Post Christmas Debt is like drinking fine wine, it tastes great at the party but leaves a massive headache in its wake.

Read moreLeverage: who’s leveraging who?

Is it leverage or self-liquidation? The two terms are often confused and sometimes used interchangeably but have quite different meanings.

Read moreProposal or Bankruptcy

It’s your choice – proposal or bankruptcy? Your LIT will guide you but not make your decisions for you! In an ideal world you would be able to live without debt.

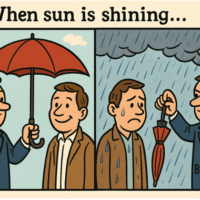

Read moreInsolvency: Bankruptcies and Proposals.

Insolvency is only one part of the solution. When the sun is shining your banker is there with an umbrella, but when it starts to rain he’ll fight you like the third monkey on the ramp to Noah’s ark to get it back.

Read moreConsumer Proposals – and social challenges.

Consumer proposals are legal arrangements between debtors and creditors that change how debts are repaid. Typically, a consumer proposal includes all debts and reduces both the principal amount owed and the monthly payment terms. Consumer proposals carry no interest, and the Licensed Insolvency Trustee’s (LIT’s) fees are not added to the payment terms; instead, they […]

Read moreWho Should Consumers Trust for Sound Financial Decisions Related to Credit?

Who should consumers trust for good financial advice? Licensed Insolvency Trustees are probably the most regulated players in entire consume debt industry. Trustees work to help you eliminate or reduce debt – the other players help you get further into debt. Choose wisely!

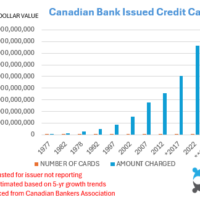

Read moreCaution: Why Now is Not the Time to Take on More Debt

Debt is not going away, it isn’t even going down, Canada’s debt crisis in widening everyday.

Read moreCredit Recycling: How Filing a Consumer Proposal or Bankruptcy Helps Consumers Rebuild Credit

Credit recycling – how an insolvency proceeding helps you get back on track

Read moreHow did I get in this mess? It’s all about the small stuff!!

How did I get in this mess? C’mon, you know the answer you just have to be honest with yourself!

Read moreFormulas for Proposals

There are no “magic” formulas for proposals – I often see and hear leader advertisements from other LIT offices with suggestions that you can write off 80% of your debt or they can fix your problems in 15-30 minutes. While both promises contain elements of truth, they also both exaggerations. Let’s start with the time […]

Read moreDivision One Proposals

Division One Proposals can filed by corporations, individuals or filed jointly.

Read moreRenegotiating Existing Proposals

If something changes, don’t despair, you can renegotiate existing proposals – talk to your LIT.

Read moreWhat is the difference between a Proposal and Bankruptcy

Licensed Insolvency Trustees are often asked “what is the difference between a Proposal and a Bankruptcy?”. The answer is a little complicated because it depends a lot on your individual circumstances. If you have no house and low income and have never been bankrupt before then a Bankruptcy may be a better solution, however, if […]

Read moreRegulate the Banks – startling statistics

Quebec introduced legislation to regulate the banks and the impact on insolvency statistics was startling.

Read moreFree Bankruptcies and Proposals

Free bankruptcies and proposals? Well not entirely, but in a sense insolvency proceedings are frequently paid for by deductions from money that would otherwise be available to Creditors. In effect then, it is they who pay for consumer proceedings.

Read moreConsumer Proposals Help Ontario Homeowners

Consumer proposals help Ontario homeowners, perhaps far more than may be expected. Reduce your debts and stay in your home.

Read moreConsumer (Proposal) Protections

The Bankruptcy & Insolvency Act does provide a number of consumer protections for people filing consumer proposals.

Read moreInsolvencies are Increasing.

After three years of highly impactful reckless lending, insolvency rates are starting to return to normal filing levels. We anticipate a slight uptick in the new year.

Read moreCompare Debt Solutions

Save your Home – what you need to know!

Canada’s first choice for debt solutions, a proposal, can help you save your home while managing debt.

Read more