Category: Insolvency News

The Debt Matrix in Canada: A System of Perpetual Financial Entrapment

Trapped in debt? Canada’s system offers relief—but not escape. Discover how insolvency resets the game without changing the rules.

Read moreWhy Selling the House and Renting Might Be the Smarter Move

Selling the house is a far better move that continuously adding more debt to the purchase price. Your $650,000 house will cost you millions and you’ll never own it! Stop mortgaging – mortgages serve one purpose to buy a house they should be abused to move debt around.

Read moreWho Should Consumers Trust for Sound Financial Decisions Related to Credit?

Who should consumers trust for good financial advice? Licensed Insolvency Trustees are probably the most regulated players in entire consume debt industry. Trustees work to help you eliminate or reduce debt – the other players help you get further into debt. Choose wisely!

Read moreCanadian Income Statistics

In Canada, the reporting of income data by Statistics Canada, the national statistical agency, can appear to be politically influenced, with data sometimes presented in ways that may not be immediately clear. While the statistics are publicly available, careful scrutiny of the data is required to understand its sources, meaning, and interpretation.

Read moreHouse Prices & Insolvency

House prices & insolvency filings have a tragic relationship, houses are the single largest purchase that the majority of people will purchase on credit. The government has put various protocols in place to provide some modicum of protection for consumers against aggressive lenders. However, even these measures have done little to help. In February 2019 […]

Read moreThe Illusion of Wealth

The illusion of wealth is an important feel-good for individuals, governments and banks, all for different reasons.

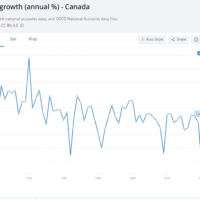

Read moreThe Changing face of Debt in Canada

Debt in Canada has outgrown all domestic production, Canadians now have about five times (5X) as much debt as they do income.

Read moreTHE PROBLEM WITH YOUR INCOME:

Income is an often overlooked economic problem in Canada, people have become so accustomed to using credit to bridge the gap between inflation and their income that they simply accept the status quo.

Read moreInsolvency Rates Rebound

The economy is in a mess, insolvency rates rebound allowing people to find relief from overwhelming debt levels. Call us today at 519-646-2222 for your free consultation.

Read moreDo the Maths

Less Bankruptcies

A recent, 2016, Court case is one of the main driving forces behind the decision to file Proposals rather than Bankruptcies.

Read moreThe Economy – a few thoughts

No one doubts the economy is in trouble, prices are go up, debt is at an all time, wages have hardly moved in years, savings are being liquidated, house prices are correcting, and everyone is desperately trying to hang onto what they have.

Read moreThe Bankruptcy & Insolvency Act

The Bankruptcy & Insolvency Act was written to help Debtors resolve problem debts and get on with living. It was never intended to be punitive or burdensome, in spite of having strict rules and regulations.

Read moreDon’t sweat the debt

Don’t sweat the debt, you do have options, the longer you wait to address debt problems the less options there may be – call today for your free consultation 519-646-2222

Read moreLiving on Debt

Living on debt has become a reality as a result of economic blunders by banks and government. With over 80,000,000 bank issued credit cards in circulation someting is clearly wrong.

Read moreRenegotiate, Reduce, and Renew your Debt

Renegotiate, Reduce and Renew your Debt – stay in control of your paycheque before things get out of hand.

Read moreGoing Up Again – interest rates that is

With rate increases going up again housing affordability start to creep upwards. House prices will undoubtedly decrease leaving zombie mortgages floating around.

Read moreHow are you doing?

How are you doing? Are you stressed? Worried about the eocnomy? Are you and your spouse arguing about money? We can help – 519-646-2222

Read moreYour Proposal Approved

Call today to book your free consultation 519-646-2222. Get your proposal approved

Read moreFix My Debt

Why fixmydebt? How did we get the url, fixmydebt.ca, and what it means to us.

Read more