Blog Articles

The Illusion of Wealth

The illusion of wealth is an important feel-good for individuals, governments and banks, all for different reasons.

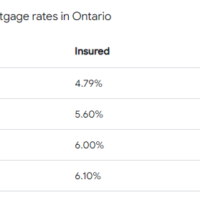

Read moreRates, Prices, and Wages

Change your focus, shift your priorities for home ownership. Rates, Prices and Wages are in reverse order, currently rates remain at an historic low, prices are far too high and wages way to low.

Read moreBank Issued Credit Cards.

Bank Issued Credit Cards are expensive and one of the most damaging aspects of the Canadian Consumer economy!

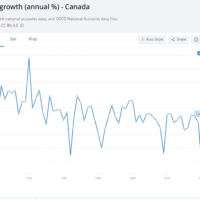

Read moreThe Changing face of Debt in Canada

Debt in Canada has outgrown all domestic production, Canadians now have about five times (5X) as much debt as they do income.

Read moreHOUSE PRICING:

There are many factors that drive house pricing, and a multitude of market conditions, some of which have been very unusual in recent years. Join the conversation, let us know what you think.

Read moreDEATH AND TAXES:

Death and taxes, so cliche, yet so appropriate when talking about Canada’s economy.

Read moreTHE PROBLEM WITH YOUR INCOME:

Income is an often overlooked economic problem in Canada, people have become so accustomed to using credit to bridge the gap between inflation and their income that they simply accept the status quo.

Read moreHousing Costs

Housing costs have dropped slightly in the home sales sector but remain high in rental markets. Meanwhile incomes are continuing to trend downwards.

Read moreInsolvency Rates Rebound

The economy is in a mess, insolvency rates rebound allowing people to find relief from overwhelming debt levels. Call us today at 519-646-2222 for your free consultation.

Read moreSurplus, what Surplus?

Surplus what surplus? If you are bankrupt and have been assessed for surplus income, and you can’t afford to pay it, do not dispair you have alternative possibilities.

Read moreEveryday Financial Risks

Prepare to face your everyday financial risks, whether they involve leverage or reach, discuss your options and explore alternative ideas.

Read moreConsumer Proposals Help Ontario Homeowners

Consumer proposals help Ontario homeowners, perhaps far more than may be expected. Reduce your debts and stay in your home.

Read moreConsumer (Proposal) Protections

The Bankruptcy & Insolvency Act does provide a number of consumer protections for people filing consumer proposals.

Read moreInsolvencies are Increasing.

After three years of highly impactful reckless lending, insolvency rates are starting to return to normal filing levels. We anticipate a slight uptick in the new year.

Read moreCompare Debt Solutions

Save your Home – what you need to know!

Canada’s first choice for debt solutions, a proposal, can help you save your home while managing debt.

Read moreDo the Maths

Surplus Income Part II – Application

This is Part II of our |Surplus Income blog describing some of the practical components of calculating surplus as well as dealing with mediation or court adjustments.

Read moreSurplus Income Part I – History

Surplus income is something that all bankrupts, and their Trustees, must consider – in Part I we look at the history of surplus income in Part II we will take a more practical view.

Read moreCEBA Update

CEBA Update, time is running out for repayment and manys small businesses are likely to have serious financial problems – we can help!

Read more